All Categories

Featured

Table of Contents

Keeping your designations up to date can ensure that your annuity will certainly be managed according to your desires should you pass away suddenly. An annual testimonial, major life events can prompt annuity owners to take an additional look at their recipient options.

Just like any financial product, seeking the help of an economic advisor can be advantageous. A monetary organizer can direct you with annuity administration procedures, including the techniques for updating your agreement's beneficiary. If no recipient is called, the payout of an annuity's fatality advantage mosts likely to the estate of the annuity holder.

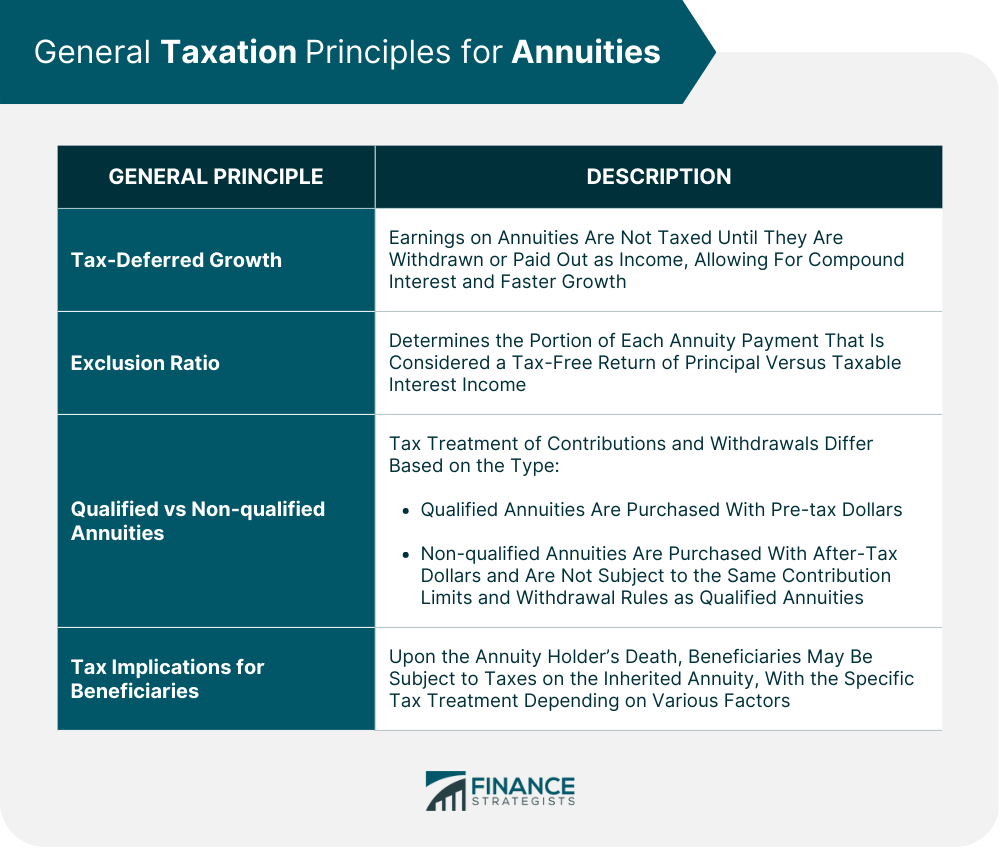

Acquiring an annuity can be a wonderful windfall, but can also elevate unforeseen tax liabilities and management problems to take care of. In this article we cover a couple of basics to be aware of when you acquire an annuity. Initially, know that there are 2 types on annuities from a tax perspective: Certified, or non-qualified.

When you take money out of an acquired qualified annuity, the total taken out will certainly be counted as gross income and strained at your common revenue tax obligation rate, which can be rather high depending upon your monetary scenario. Non-qualified annuities were moneyed with cost savings that already had tax obligations paid. You will certainly not owe taxes on the initial cost basis (the total contributions made originally right into the annuity), but you will still owe tax obligations on the growth of the investments nevertheless which will certainly still be strained as earnings to you.

Particularly if the initial annuity proprietor had actually been receiving payments from the insurance policy company. Annuities are normally developed to offer revenue for the initial annuity proprietor, and after that discontinue payments as soon as the initial proprietor, and perhaps their partner, have passed. There are a few circumstances where an annuity may leave a benefit for the beneficiary inheriting the annuity: This suggests that the first owner of the annuity was not obtaining regular repayments from the annuity.

The beneficiaries will certainly have several alternatives for how to obtain their payment: They may keep the cash in the annuity, and have the assets relocated to an acquired annuity account (Period certain annuities). In this instance the assets may still remain invested and continue to expand, nevertheless there will certainly be needed withdrawal guidelines to be mindful of

Period Certain Annuities inheritance taxation

You might also have the ability to pay out and obtain a swelling amount payment from the acquired annuity. Be certain you recognize the tax obligation effects of this decision, or talk with a financial consultant, due to the fact that you might be subject to considerable earnings tax obligation responsibility by making this political election. If you choose a lump-sum payment alternative on a certified annuity, you will certainly subject to earnings taxes on the entire value of the annuity.

One more attribute that may exist for annuities is an assured survivor benefit (Joint and survivor annuities). If the original proprietor of the annuity elected this feature, the beneficiary will be qualified for an one-time round figure benefit. Exactly how this is tired will certainly depend on the sort of annuity and the worth of the survivor benefit

The particular policies you should comply with rely on your connection to the person that died, the kind of annuity, and the phrasing in the annuity agreement sometimes of purchase. You will have a collection timespan that you should withdrawal the assets from the annuity after the first owners death.

As a result of the tax obligation repercussions of withdrawals from annuities, this indicates you need to very carefully intend on the finest method to withdraw from the account with the least expensive amount in tax obligations paid. Taking a huge round figure may push you into extremely high tax brackets and lead to a bigger part of your inheritance going to pay the tax obligation expense.

It is likewise essential to know that annuities can be traded. This is referred to as a 1035 exchange and allows you to move the cash from a certified or non-qualified annuity right into a different annuity with another insurer. This can be a great alternative if the annuity agreement you acquired has high charges, or is simply not right for you.

Managing and spending an inheritance is incredibly important duty that you will be forced right into at the time of inheritance. That can leave you with a great deal of questions, and a great deal of possible to make pricey blunders. We are right here to assist. Arnold and Mote Wealth Management is a fiduciary, fee-only financial planner.

Tax consequences of inheriting a Annuity Fees

Annuities are one of the several devices financiers have for building riches and protecting their economic wellness. There are various types of annuities, each with its own benefits and functions, the essential facet of an annuity is that it pays either a series of payments or a lump amount according to the agreement terms.

If you lately inherited an annuity, you may not know where to begin. That's totally understandablehere's what you must know. In addition to the insurer, numerous parties are entailed in an annuity contract. Annuity proprietor: The person that gets in right into and spends for the annuity contract is the proprietor.

An annuity may have co-owners, which is often the situation with partners. The owner and annuitant may be the exact same individual, such as when someone acquisitions an annuity (as the proprietor) to provide them with a repayment stream for their (the annuitant's) life.

Annuities with numerous annuitants are called joint-life annuities. As with multiple proprietors, joint-life annuities are a typical framework with couples because the annuity continues to pay the making it through spouse after the first partner passes.

It's possible you might receive a survivor benefit as a beneficiary. That's not constantly the instance. When a survivor benefit is activated, payments may depend partly on whether the proprietor had currently started to obtain annuity settlements. An acquired annuity survivor benefit works in a different way if the annuitant wasn't currently getting annuity repayments at the time of their death.

When the advantage is paid to you as a lump amount, you get the whole quantity in a solitary payout. If you choose to receive a payment stream, you will have several options available, relying on the contract. If the proprietor was currently receiving annuity payments at the time of death, after that the annuity agreement might simply end.

Table of Contents

Latest Posts

Decoding How Investment Plans Work A Comprehensive Guide to Variable Annuity Vs Fixed Annuity What Is Variable Vs Fixed Annuities? Benefits of Deferred Annuity Vs Variable Annuity Why Choosing the Rig

Highlighting the Key Features of Long-Term Investments A Closer Look at What Is Variable Annuity Vs Fixed Annuity Defining Indexed Annuity Vs Fixed Annuity Features of Variable Annuity Vs Fixed Indexe

Exploring What Is Variable Annuity Vs Fixed Annuity Everything You Need to Know About Pros And Cons Of Fixed Annuity And Variable Annuity Breaking Down the Basics of Investment Plans Pros and Cons of

More

Latest Posts