All Categories

Featured

Table of Contents

Section 691(c)( 1) provides that a person that consists of an amount of IRD in gross earnings under 691(a) is allowed as a deduction, for the same taxed year, a section of the estate tax obligation paid by reason of the inclusion of that IRD in the decedent's gross estate. Normally, the quantity of the reduction is computed utilizing inheritance tax values, and is the quantity that bears the very same ratio to the estate tax obligation attributable to the web worth of all IRD products consisted of in the decedent's gross estate as the value of the IRD consisted of in that person's gross income for that taxed year births to the value of all IRD items consisted of in the decedent's gross estate.

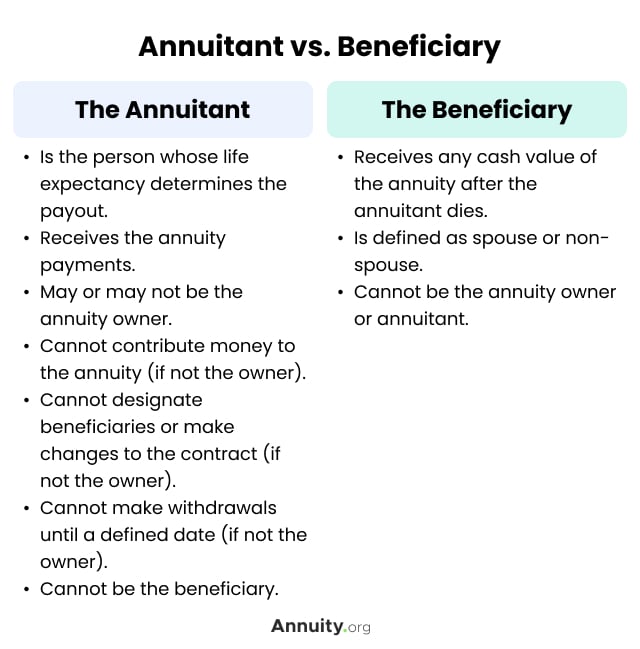

Rev. Rul., 1979-2 C.B. 292, attends to a circumstance in which the owner-annuitant purchases a deferred variable annuity agreement that supplies that if the proprietor dies prior to the annuity beginning date, the called beneficiary might elect to get the present accumulated value of the contract either in the kind of an annuity or a lump-sum repayment.

Rul. If the recipient chooses a lump-sum repayment, the excess of the amount obtained over the quantity of factor to consider paid by the decedent is includable in the recipient's gross revenue.

Rul. Had the owner-annuitant gave up the agreement and received the amounts in unwanted of the owner-annuitant's financial investment in the contract, those quantities would certainly have been revenue to the owner-annuitant under 72(e).

Fixed Income Annuities inheritance and taxes explained

Similarly, in today instance, had A surrendered the contract and obtained the quantities at problem, those quantities would have been earnings to A under 72(e) to the extent they surpassed A's financial investment in the agreement. Accordingly, amounts that B gets that surpass A's financial investment in the contract are IRD under 691(a).

, those quantities are includible in B's gross income and B does not get a basis adjustment in the agreement. B will certainly be entitled to a reduction under 691(c) if estate tax was due by factor of A's death.

The holding of Rev. Rul. 70-143 (which was revoked by Rev. Rul. 79-335) will remain to get deferred annuity agreements purchased before October 21, 1979, including any type of contributions used to those agreements according to a binding dedication got in into before that day - Period certain annuities. PREPARING INFORMATION The primary author of this profits judgment is Bradford R

Q. Exactly how are annuities taxed as an inheritance? Exists a difference if I inherit it straight or if it goes to a count on for which I'm the recipient?-- Planning aheadA. This is a wonderful question, yet it's the kind you should require to an estate planning attorney that knows the information of your situation.

What is the partnership in between the departed owner of the annuity and you, the recipient? What kind of annuity is this?

We'll presume the annuity is a non-qualified annuity, which indicates it's not component of an IRA or various other qualified retirement plan. Botwinick stated this annuity would certainly be added to the taxed estate for New Jersey and federal estate tax functions at its date of fatality value.

Are Lifetime Annuities death benefits taxable

citizen partner exceeds $2 million. This is understood as the exemption.Any amount passing to a united state citizen spouse will certainly be entirely excluded from New Jersey inheritance tax, and if the owner of the annuity lives throughout of 2017, after that there will certainly be no New Jacket inheritance tax on any kind of amount due to the fact that the estate tax is set up for abolition beginning on Jan. Then there are federal inheritance tax.

"Currently, income taxes.Again, we're thinking this annuity is a non-qualified annuity. If estate tax obligations are paid as an outcome of the incorporation of the annuity in the taxable estate, the recipient may be entitled to a reduction for inherited income in regard of a decedent, he said. Recipients have multiple options to think about when selecting how to receive cash from an inherited annuity.

Table of Contents

Latest Posts

Decoding How Investment Plans Work A Comprehensive Guide to Variable Annuity Vs Fixed Annuity What Is Variable Vs Fixed Annuities? Benefits of Deferred Annuity Vs Variable Annuity Why Choosing the Rig

Highlighting the Key Features of Long-Term Investments A Closer Look at What Is Variable Annuity Vs Fixed Annuity Defining Indexed Annuity Vs Fixed Annuity Features of Variable Annuity Vs Fixed Indexe

Exploring What Is Variable Annuity Vs Fixed Annuity Everything You Need to Know About Pros And Cons Of Fixed Annuity And Variable Annuity Breaking Down the Basics of Investment Plans Pros and Cons of

More

Latest Posts